Third-party shipping is a huge part of today’s e-commerce landscape. Therefore it is vital to understand this fee and know how it is affecting your daily shipping costs. Beginning in 2016, UPS began charging a third-party billing fee of 2.5% of the total shipping charge billed to the Third Party.

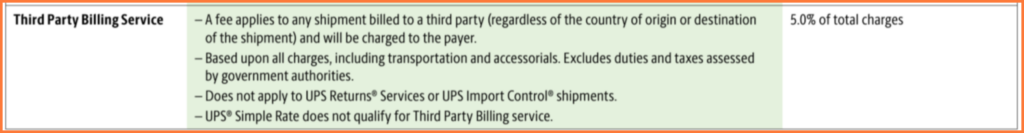

However, this fee applied to shipments billed to a 3rd party increased to 5.0% this year. In addition, this fee applies to all UPS domestic and international shipments. The 5.0% is applied to the entire shipping charge, which includes the base rate plus all applicable accessorial and value-added service charges.

What is a 3rd Party Shipper?

UPS provides a variety of options to help manage shipping costs by allowing the shipper to determine who pays the shipping charges. Unless otherwise specified at the time of shipping, shipping charges are automatically billed to the shipper. Consequently, in the event of non-payment by the consignee or a third party, all charges will apply to the shipper.

UPS accepts shipments for 3rd party billing (subject to a fee), provided the third party has a valid UPS account number and agrees to allow the charges. Regardless of the billing option selected, some additional charges (i.e., address correction charges) will apply to the shipper’s account.

These are the UPS billing payer options:

- Shipper Billing (Prepaid) – Shipper’s UPS account receives shipping charges.

- Receiver Billing (Freight Collect) – Receiver’s UPS account receives shipping charges.

- Bill Third Party – A third party’s UPS account receives shipping charges. This is the option we will focus on.

The UPS Third Party Billing Service fee is described in Section 44 of the UPS service guide. The fee applies to all UPS services worldwide, regardless of origin or destination. UPS defines “Third Party” as any party that is not the Shipper or Receiver/Consignee.

UPS Third Party Billing is not available for UPS Returns Services in the US. Conversely, 3rd party billing is available for UPS Returns Services outside the United States.

UPS Service Guide: 44. Third Party Billing Service

Any Shipment billed to a Third Party (regardless of the country of origin or destination of the Shipment) is subject to a Third Party Billing Service fee, charged to the payer, set forth in the Service Guide at the time of shipping. The fee for Third Party Billing Service shall be charged for each transaction, based upon all Charges, excluding charges, duties

and taxes assessed by government authorities. The Third Party Billing Service fee will not apply to UPS Returns Services or UPS Import Control Shipments.

How can we reduce UPS third-party billing fees?

Our first reaction to this fee is to, of course, negotiate with your carrier representative to have this fee removed or discounted. A full UPS agreement renegotiation should include concessions for all the fees that are impacting your shipping spend. Before you head down this path, know your data. Ask yourself the following questions:

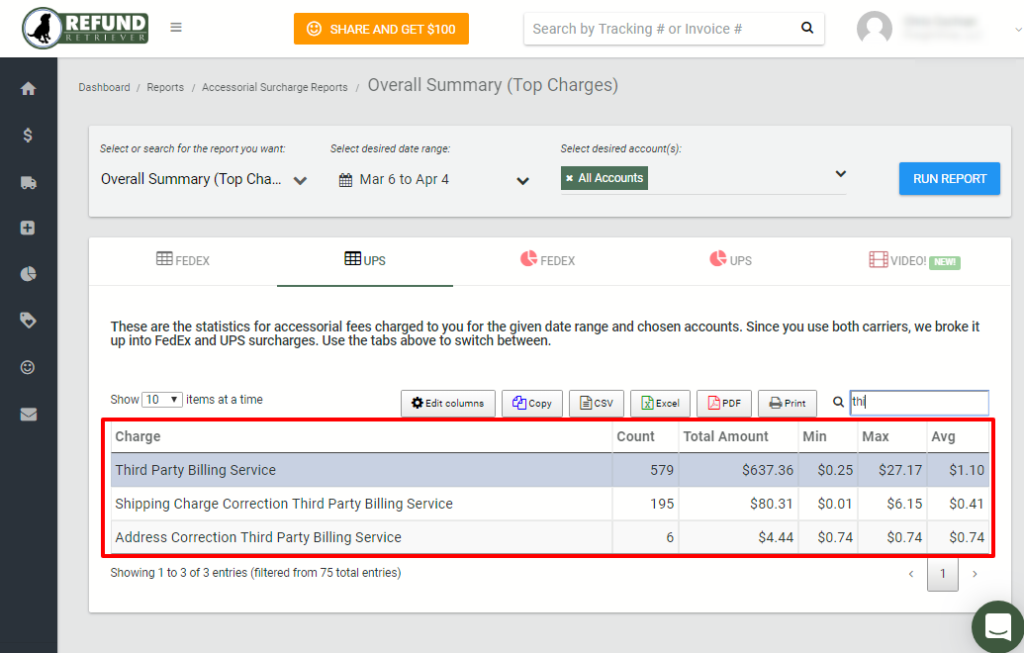

- How much per year does this fee cost my company?

- What percentage of my packages are affected by the UPS third-party billing fee?

- What percentage of my company’s total shipping spend is due to this fee?

If you are seeing this fee have a true impact on your transportation costs then try for a contract negotiation concession. Otherwise, ask for a large discount on UPS ground third party package rates to compensate for the additional charge. For instance, the contract could stipulate a 30% discount on UPS ground residential charges and a 35% discount on UPS ground residential third party charges.

Another answer we have seen would be to change your UPS billing address to the location of your drop shipper. If you use UPS online billing, the paper invoices will never be sent, and you are able to view the invoice online. We are not sure if this works, so if you have done this drop us a line and provide some feedback!

Final considerations

If you are shipping on another person’s UPS account as per their request, be aware of possible chargebacks. Monitor your invoice on a regular basis for chargebacks. The payer of the charges, in this case, it would be the third party payor, has 180 days to dispute the charges and reapply them back to your account number. If you ever use 3rd party or