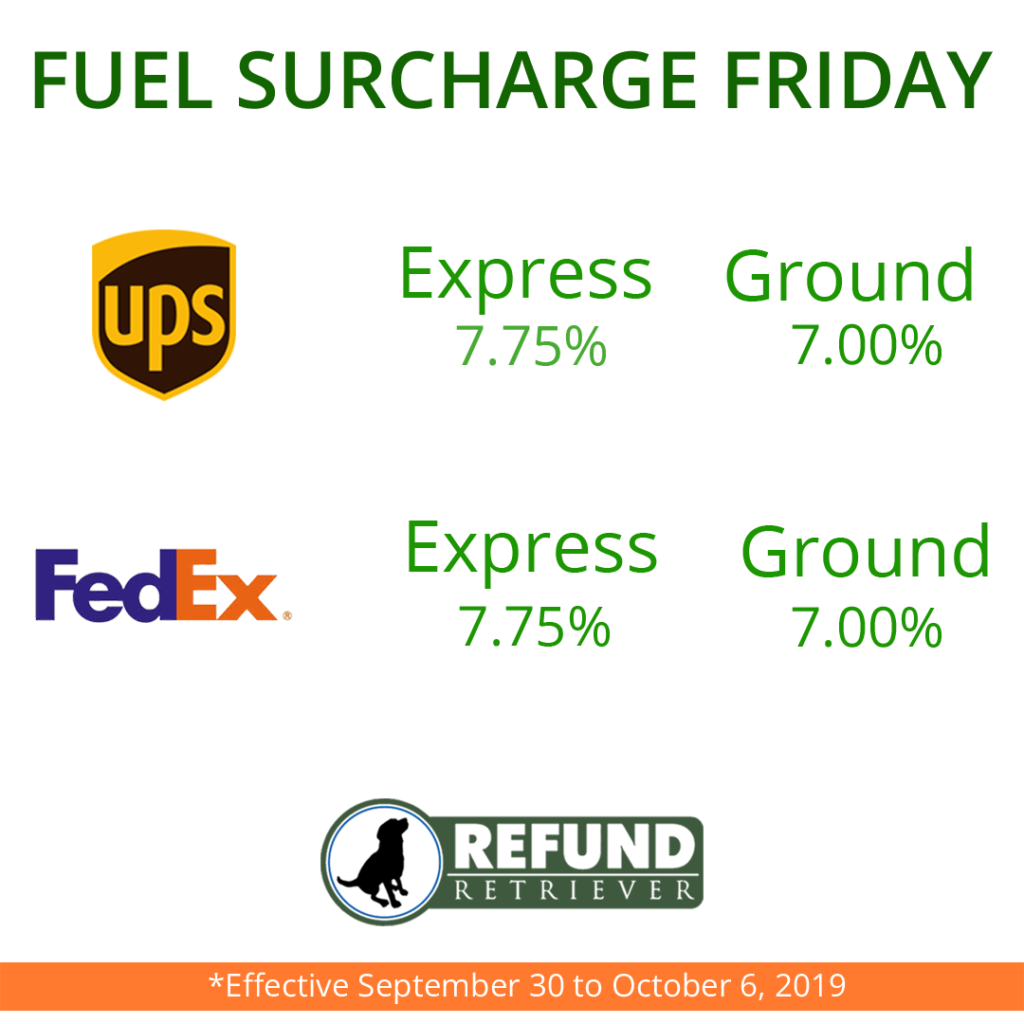

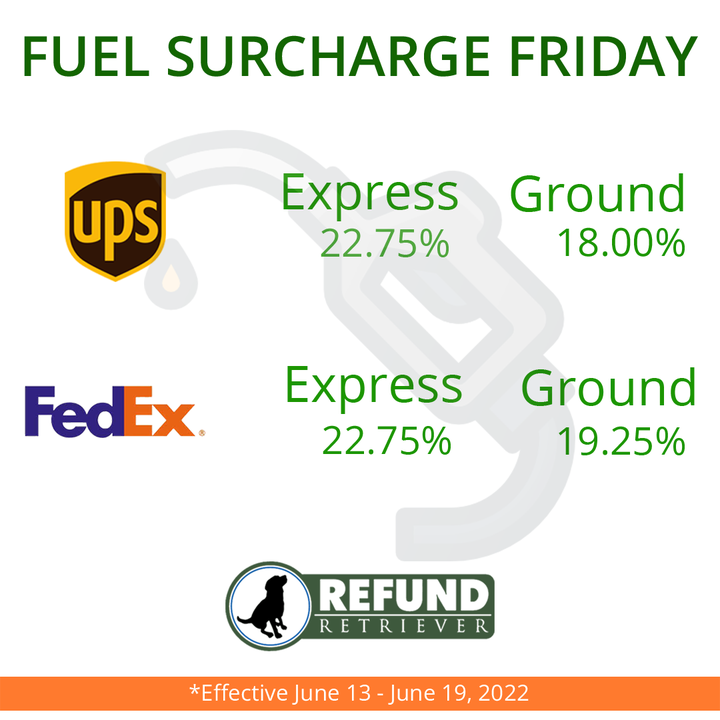

FedEx and UPS fuel surcharges are at an all-time high. By the time this blog is live, the fuel surcharge will be even higher. UPS express fuel surcharge is 22.75%, and the ground is 18% as of June 13, 2022. FedEx express fuel surcharge is 22.75%, and the ground is 19.25% as of June 13, 2022.

Estimated reading time: 6 minutes

What is a Small Parcel Fuel Surcharge?

The cost of fuel and transportation impact delivery companies considerably. The surcharge helps protect carriers from high gasoline, diesel, and airplane fuel prices. UPS and FedEx add a fuel surcharge percentage to import and export shipments, raising the overall price. The fuel surcharge fee applies to the published transportation cost and some accessorial fees.

How are Fuel Surcharges Calculated?

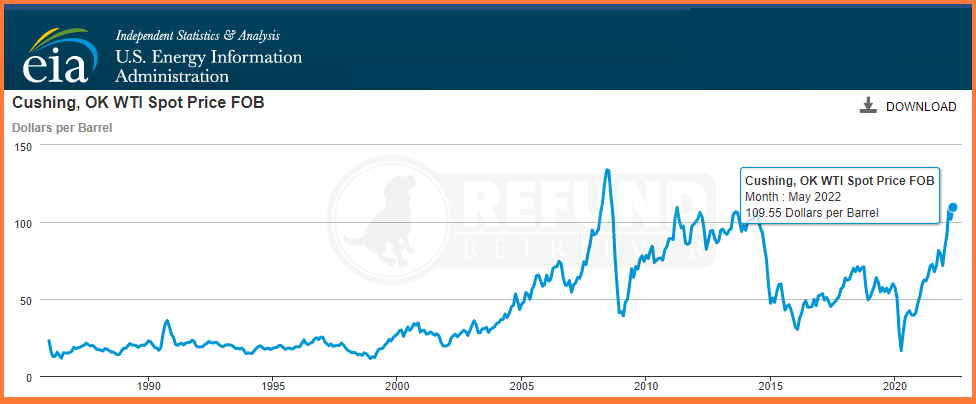

UPS and FedEx use an index-based surcharge adjusted on Monday of each week. The UPS fuel surcharge is based on the National U.S. Average On-Highway Diesel Fuel Price released by the U.S. Energy Information Administration (EIA). The express fuel surcharge is based on the U.S. Gulf Coast (USGC) price for kerosene-type jet fuel.

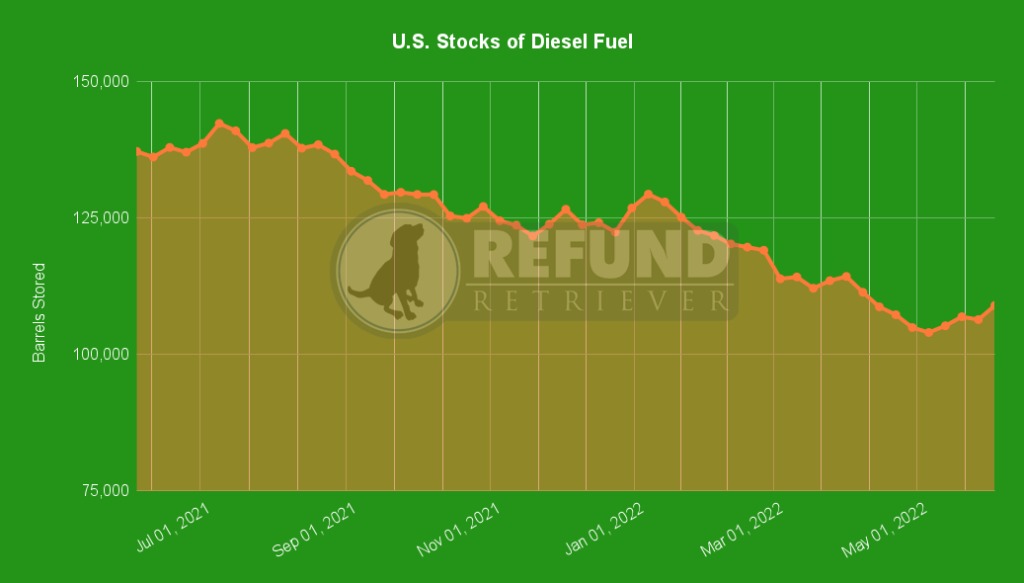

Diesel prices have skyrocketed faster than gasoline, which has hit record levels. Generally, they’re rising quickly because of the same factors that have increased oil prices this year. The U.S.’s ban on importing Russian oil after the invasion of Ukraine has put an additional squeeze on diesel.

Diesel and Gas Prices

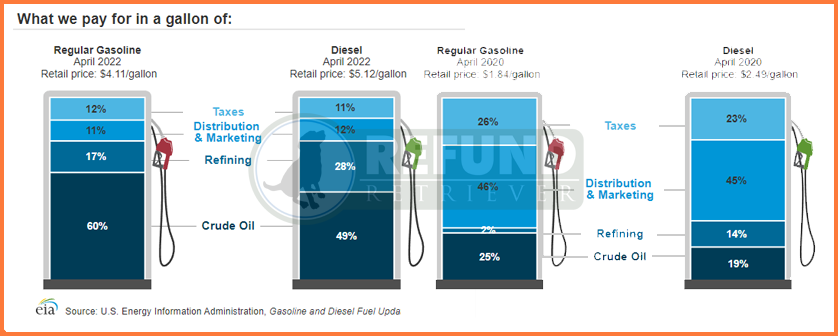

On June 14, 2022, the national average price of gasoline is $5.016, and the national average cost of diesel is $5.775. But if we want to know why diesel costs are increasing faster than regular gasoline, we need to look at those refining costs. It doesn’t matter how much the U.S. can drill unless we can refine it. We have become dependent upon foreign refiners. Further increasing the fuel surcharge crisis.

The lack of refining capacity has a lot to do with the shutdown of six refineries and the impending closure of a seventh at the end of 2023.

Current Crude Oil Refining Capacity

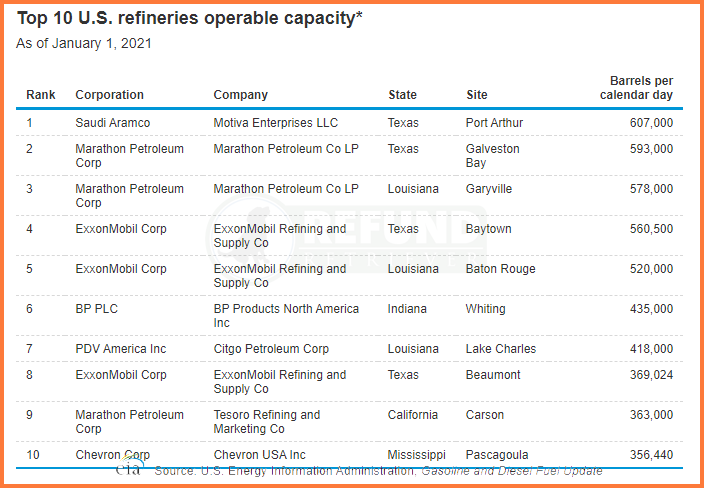

The U.S. rarely builds oil refineries anymore. According to the EIA, the newest refinery in the United States is the Targa Resources site in Channelview, Texas. Accordingly, the latest refinery began operating in 2019 and processes 35,000 barrels daily. Only five refineries have been built in the past two decades, which is bad news for fuel surcharges prices. The Marathon plant in Louisiana was the largest refinery built in the past 50 years; it refines 578,000 barrels daily.

At the beginning of 2021, the U.S. had 129 operating refineries, down from 135 operable refineries listed at the beginning of 2020. The cost of refining diesel fuel is currently 28% of the total cost, double the cost in 2020.

Refinery Closings

On June 21, 2019, massive explosions occurred at the Philadelphia Energy Solutions refinery. Not long after, PES filed for bankruptcy and closed what was the largest refinery on the east coast. Five more shut down throughout 2020. Those six refineries collectively refined more than 1 million barrels of oil daily.

Additionally, Chemical maker Lyondell Basell Industries announced in April that the company will permanently close its Houston crude-oil refinery by the end of 2023. According to U.S. government data, Lyondell’s plant can produce 89,000 barrels per day of gasoline, 44,500 barrels of jet fuel, and 92,600 barrels of diesel. If the void this closure creates is not filled or eliminated, fuel surcharges will continue to rise.

Price of Crude Oil

Increase Demand, Decreasing Supply

Why are we experiencing these incredible fuel prices? Because we’re getting back to pre-pandemic levels of demand, while our refineries are pumping out about a million fewer gallons of fuel per day than before the pandemic. Lower supply with higher demand causes prices to rise.

It will not do U.S. consumers much good to expand the supply of crude oil if there isn’t enough refinery capacity to turn that oil into products. And right now, no major projects are planned to build new oil refineries or expand capacity at the existing ones. Oil companies decreased their investments at all stages of exploration, drilling, obtaining, and refining their product. Furthermore, in April, the second-largest state-owned Russian energy company announced that they would cut diesel exports to zero, and this will cause fuel surcharges to increase even more.

Refund Retriever Fuel Surcharge Savings

Refund Retriever’s shipping intelligence can empower shippers to regain control of shipping costs and push significant savings. In addition, many business owners do not have time to negotiate savings on carrier contract agreements. Our contract negotiation services save companies like yours up to 35% each year.

Shipping contracts from UPS and FedEx are confusing, and small parcel agreements contain pricing tiers with different discounts for weights and service levels. Our experts of analysts understand contract carrier agreements and fuel surcharges. We analyze your current shipping usage to give insights that help negotiate the most profitable contracts. In conclusion, if shipping savings interest you, reach out to Refund Retriever today.